Renters Insurance: Essential Coverage Guide

Comprehensive overview of renters insurance including personal property coverage, liability protection, and additional living expenses for Canadian tenants.

Understand unique insurance needs for renters and condo owners. Learn the differences between unit coverage and building coverage, strata responsibilities, and tenant rights in Canadian housing arrangements.

Comprehensive overview of renters insurance including personal property coverage, liability protection, and additional living expenses for Canadian tenants.

Understand the differences between your condo insurance and strata corporation coverage, identifying gaps and ensuring comprehensive protection.

Learn what your strata corporation covers, common exclusions, and how to identify what additional coverage you need as a condo owner.

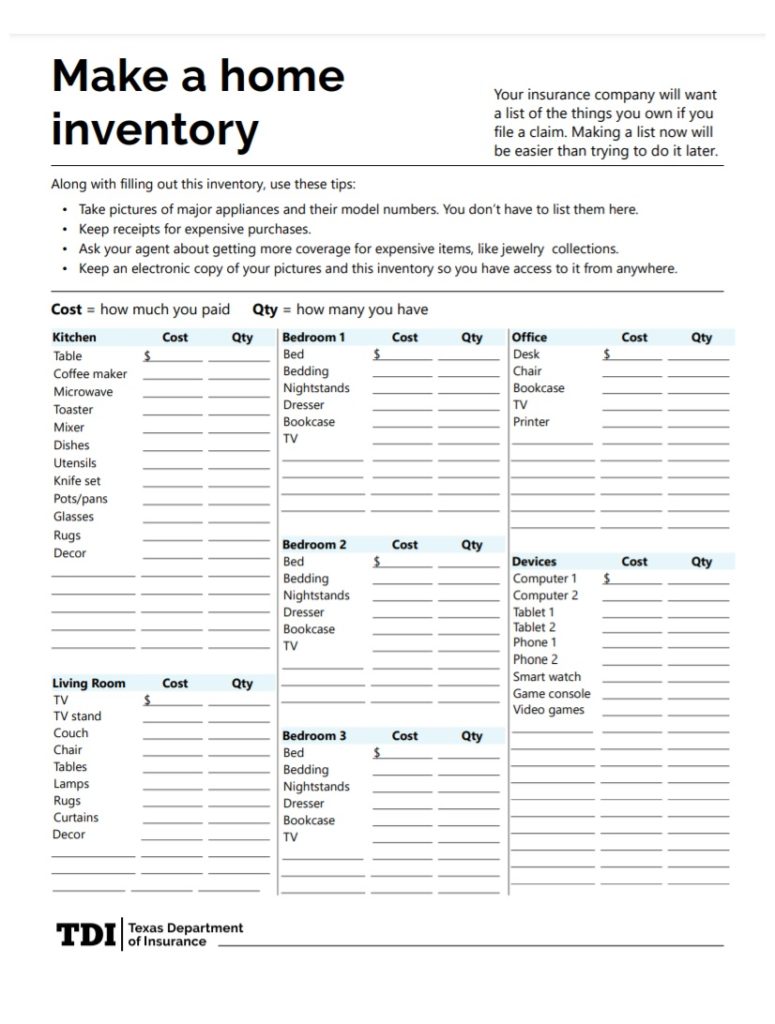

Protect your belongings as a renter including coverage limits, replacement cost vs. actual cash value, and documentation requirements.

Coverage for renovations, upgrades, and improvements you make to your condo unit that may not be covered by the strata corporation insurance.

Understand your rights as a tenant in Canada, insurance requirements by province, and how to handle disputes with landlords.

Decode strata insurance policies, understand coverage boundaries, and identify potential coverage gaps that require additional insurance.

Understand liability coverage for condo owners including personal liability, loss assessment coverage, and protection against common condo risks.

Understand what constitutes your unit vs. common property. Coverage typically starts at the walls in, but verify with your strata documents.

Protection against special assessments charged by the strata for uninsured losses that exceed the corporation's insurance coverage.

Coverage for renovations and upgrades you make to your unit that may not be included in the base strata coverage.