Filing Your First Insurance Claim

Step-by-step guide to filing your first home insurance claim, including initial contact procedures, required information, and setting realistic expectations.

Master the insurance claims process with confidence. Learn filing procedures, timeline management, documentation requirements, and effective communication with adjusters to maximize your claim success.

Step-by-step guide to filing your first home insurance claim, including initial contact procedures, required information, and setting realistic expectations.

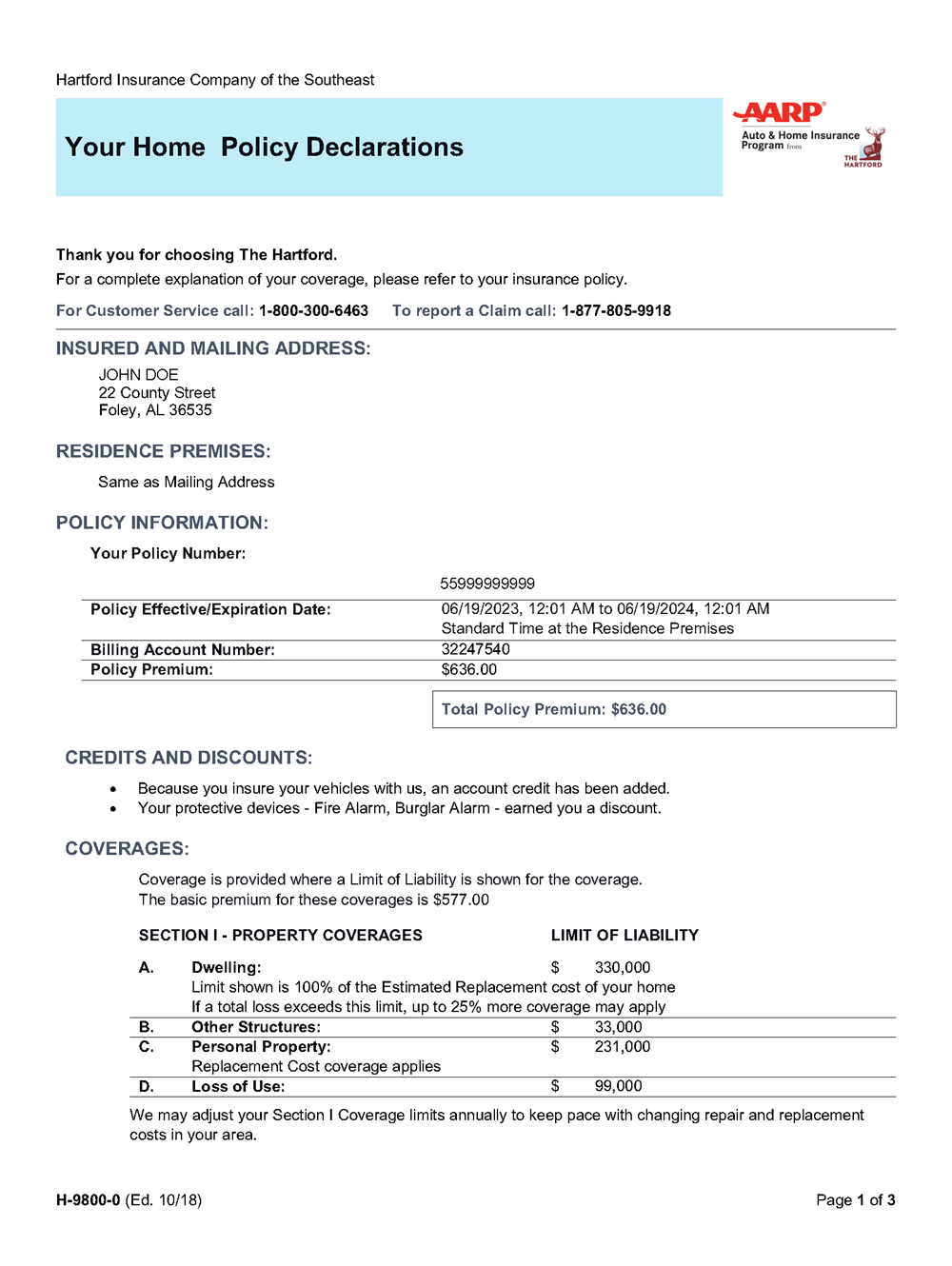

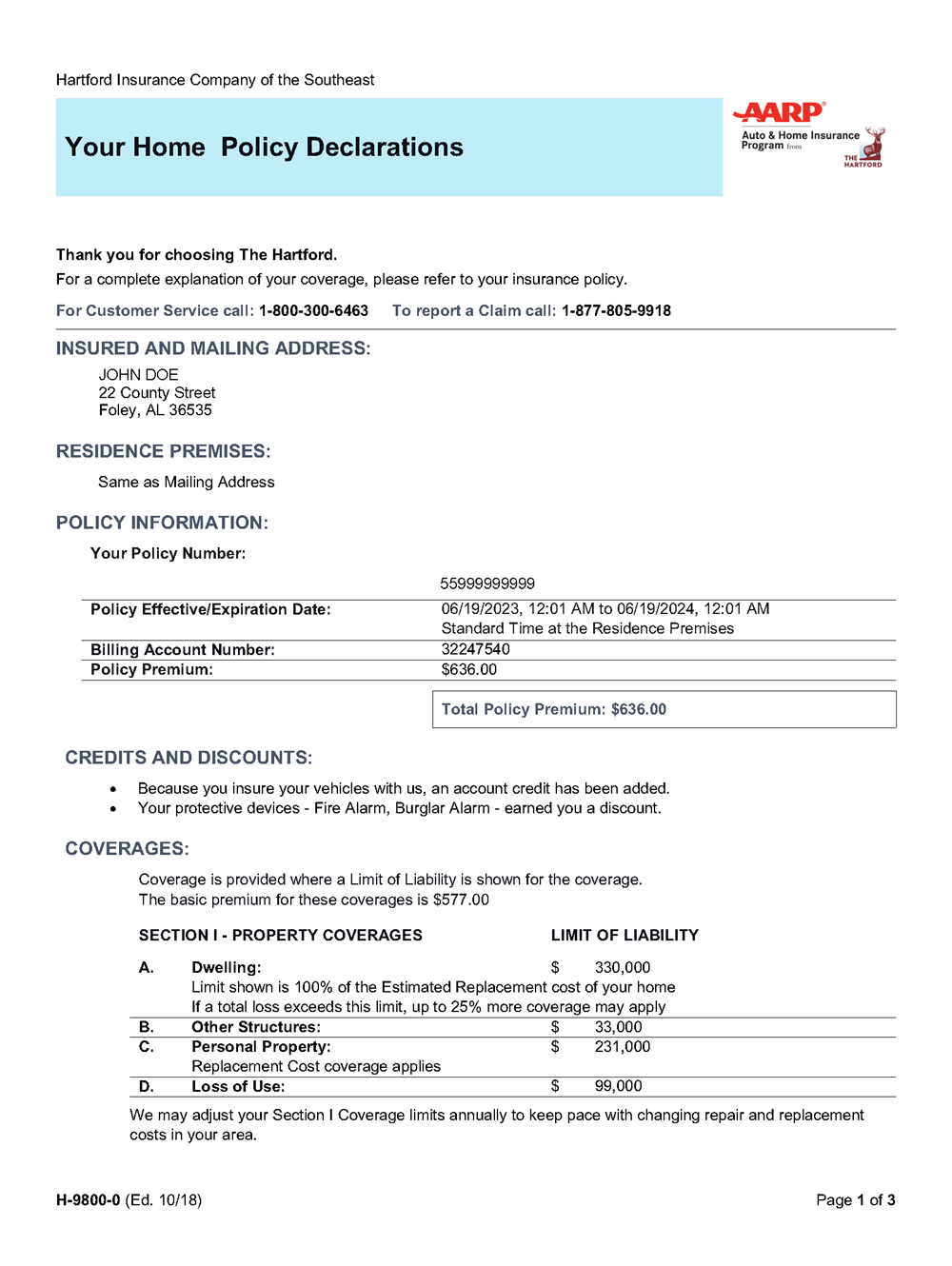

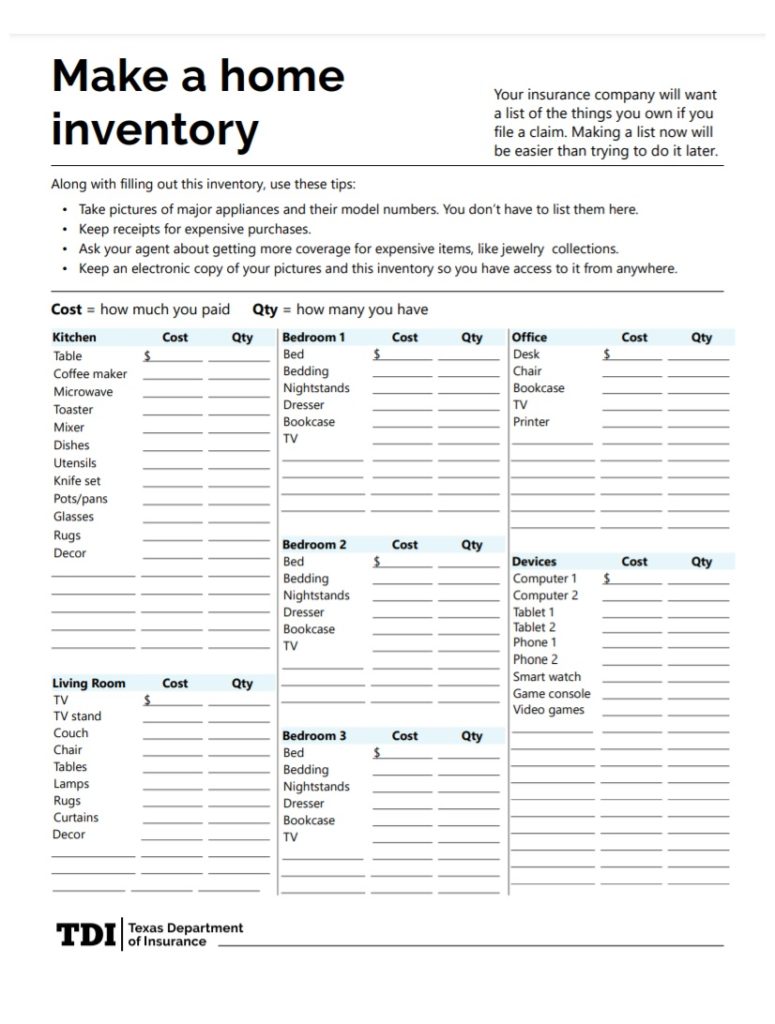

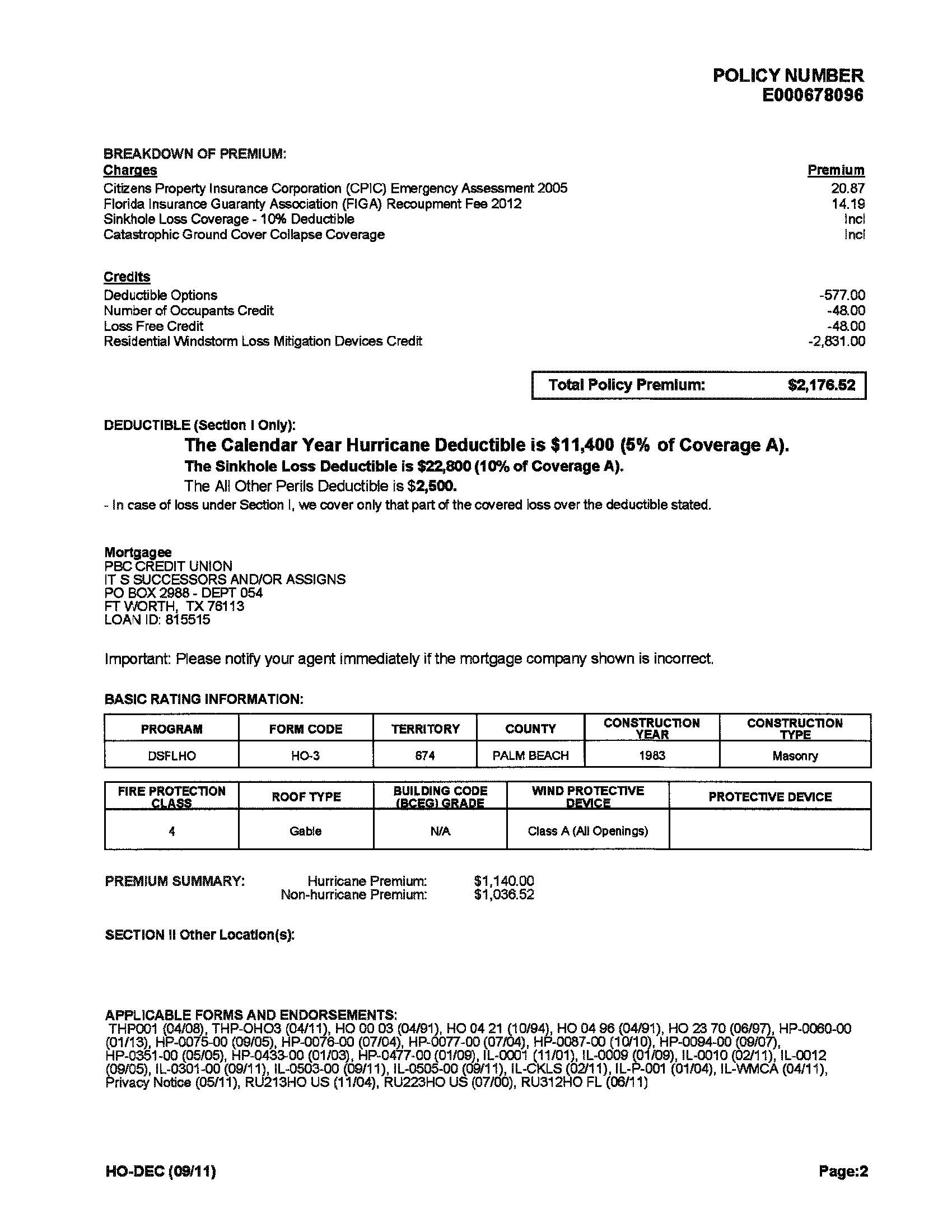

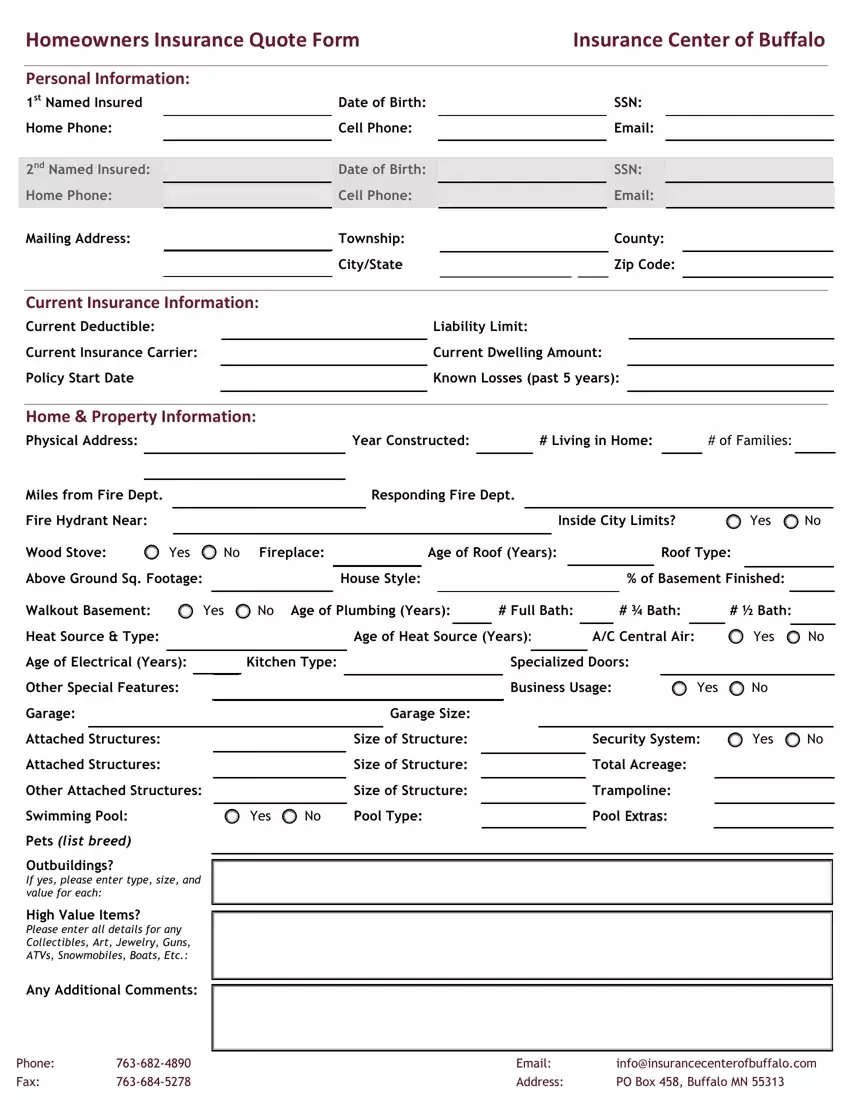

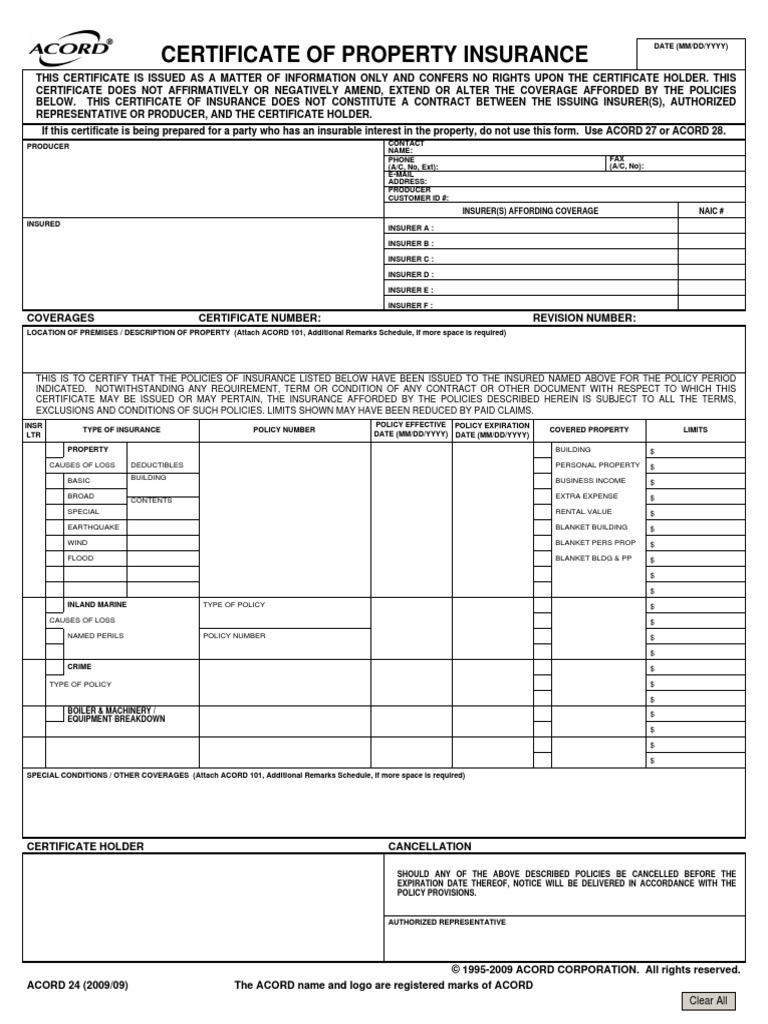

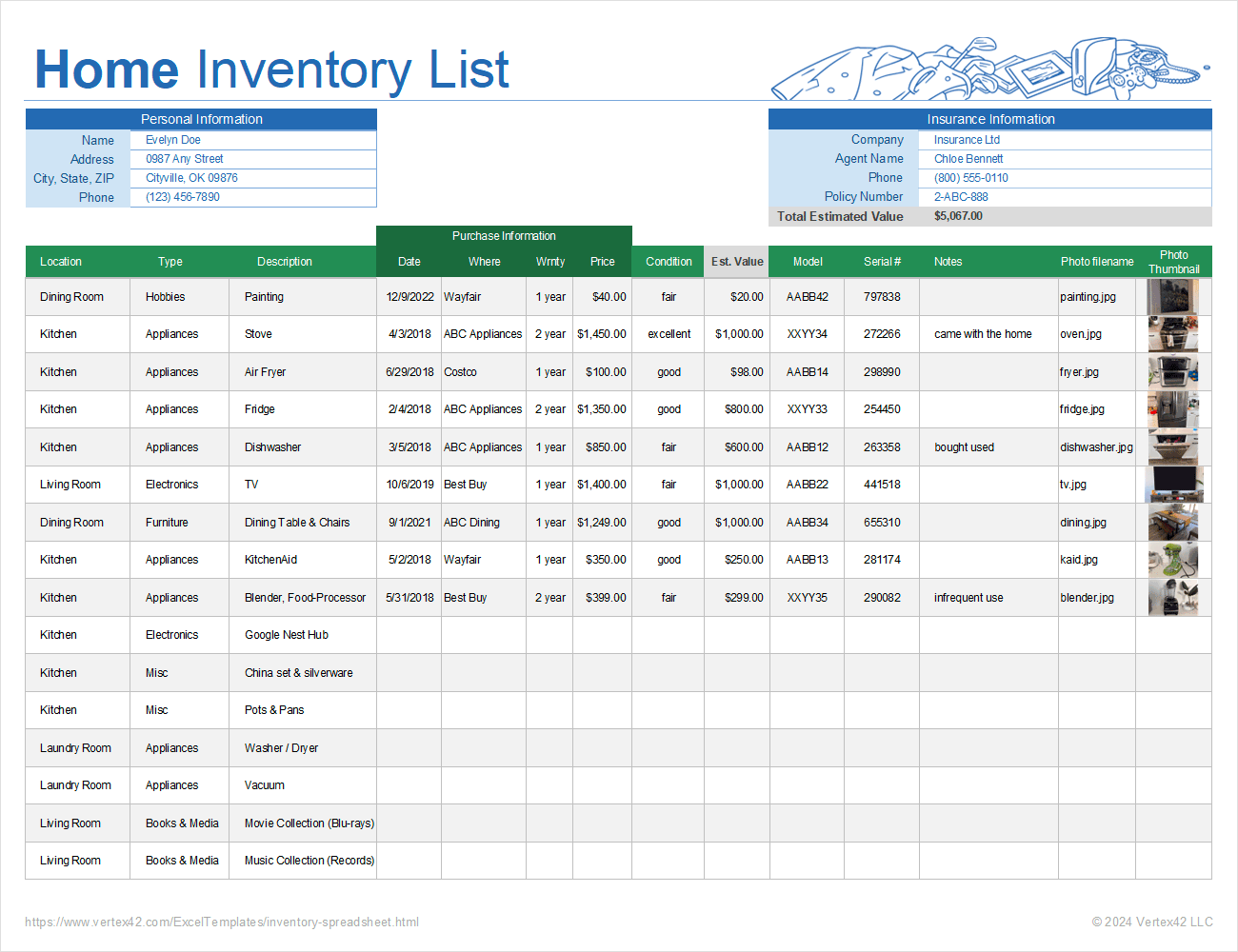

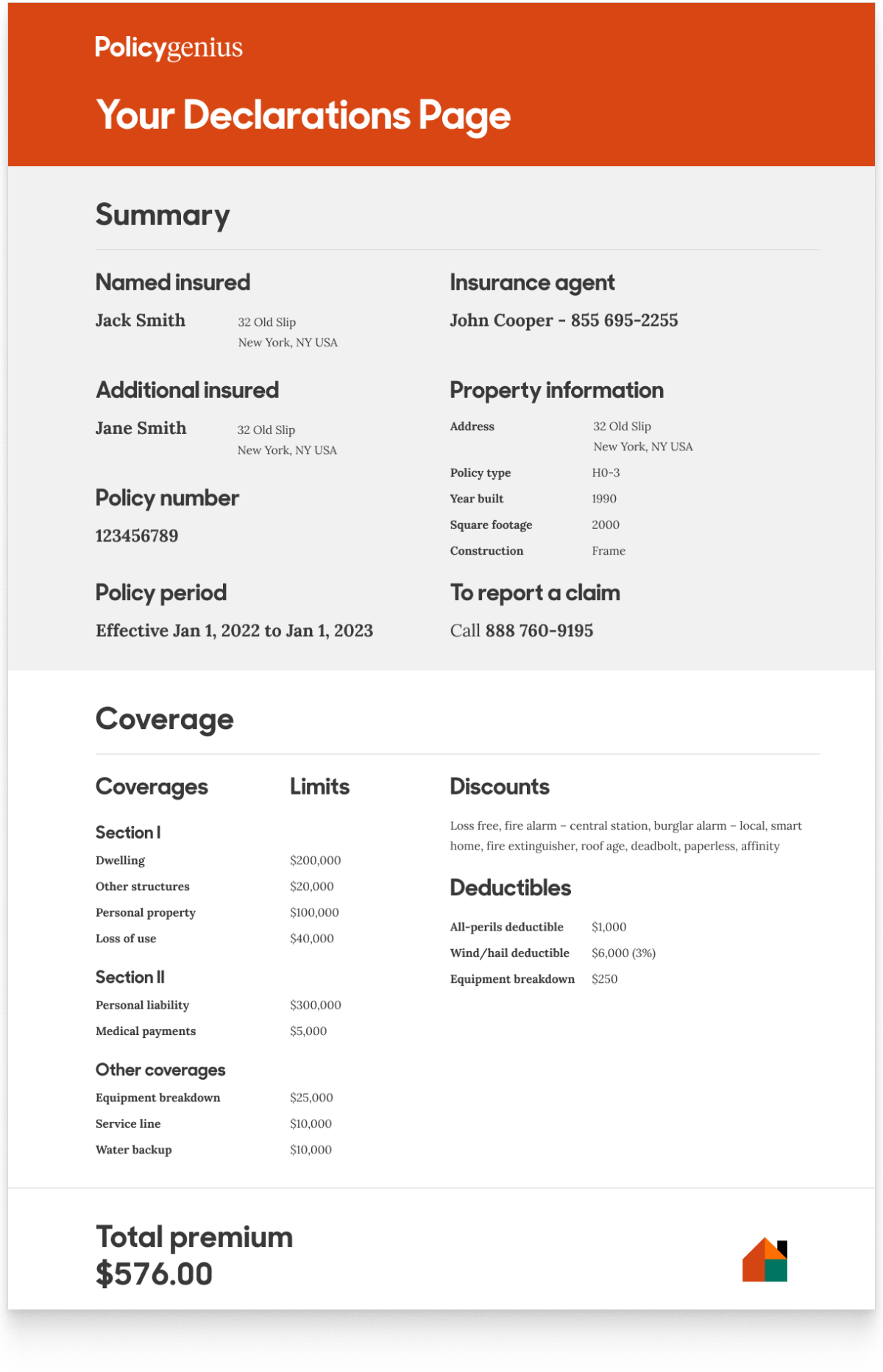

Comprehensive list of documents needed for successful claims processing, including photos, receipts, estimates, and supporting evidence.

Understand the adjuster's role, prepare for meetings, present evidence effectively, and maintain professional communication throughout the process.

Realistic expectations for claim processing timelines, factors that affect duration, and proactive steps to keep your claim moving efficiently.

How to prepare your home for adjuster inspections, what to expect during the visit, and how to present damage effectively.

Professional techniques for documenting damage with photos and videos that provide clear evidence for your insurance claim.

Effective communication strategies with your insurance company, following up on pending claims, and escalation procedures when necessary.

Navigating emergency claims, temporary housing arrangements, and additional living expenses coverage during major repairs.

Maintain regular contact with your adjuster, respond promptly to requests, and keep detailed records of all conversations and correspondence.

Create a comprehensive file with all claim-related documents, maintain chronological order, and backup digital copies securely.

Know your policy rights, ask questions when unclear, and don't hesitate to escalate concerns or seek professional assistance.